hotel tax calculator texas

NA tax not levied on accommodations. Multiply the answer by 100 to get the rate.

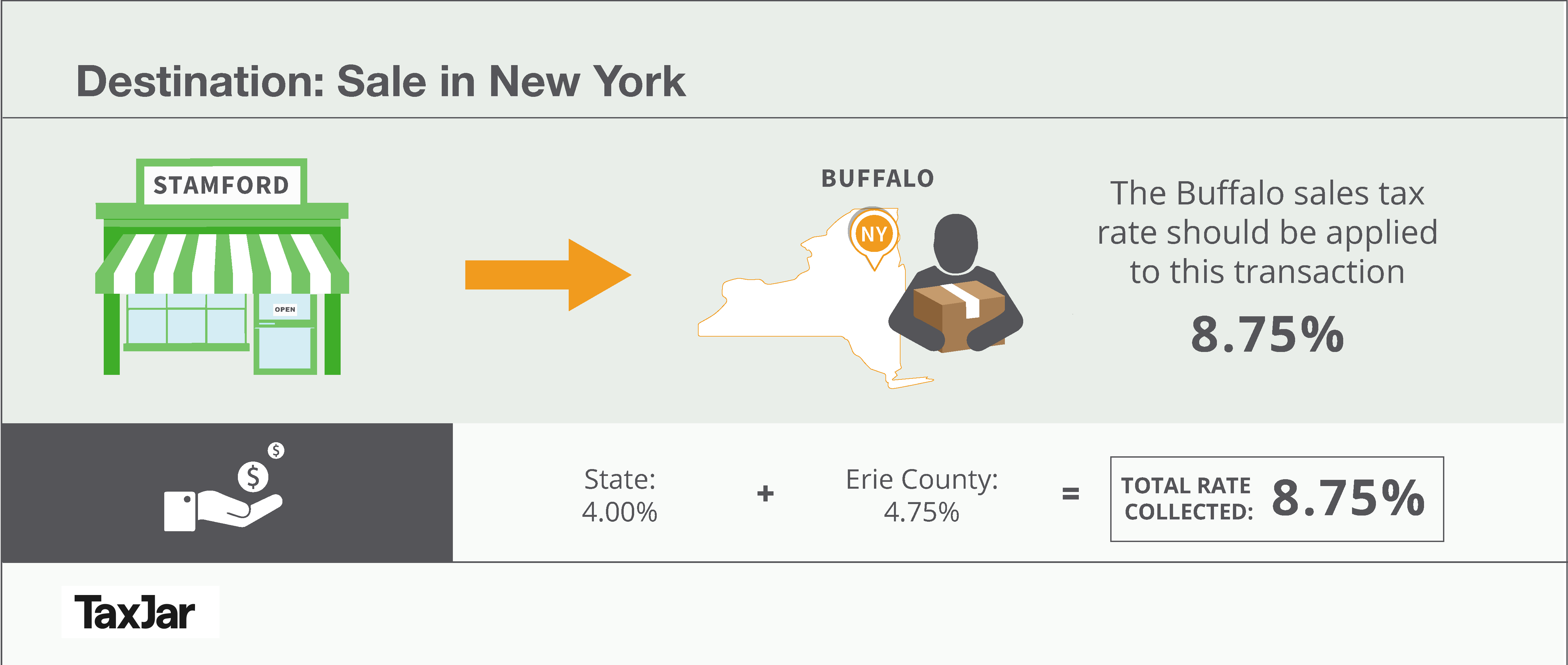

How To Charge Your Customers The Correct Sales Tax Rates

A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

. Texas Tax Code Chapter 351 and Tax Code Chapter 352 give municipalities the authorization to levy a tax on a person who pays for the use of a hotel room as defined by Tax Code Chapter 156. HOW TO CALCULATE HOTEL TAX. Texas Hotel Occupancy Tax.

Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache. Sr Special Sales Tax Rate. 12-302 Texas Hotel Occupancy Tax Exemption Certificate PDF AP-102 Hotel Occupancy Tax Questionnaire PDF 12-100 Hotel Occupancy Tax Report PDF 12-101 Hotel Occupancy Tax Report Location Supplement PDF External Link.

Please read and adhere to the Hotel Occupancy Tax Reporting Payment Requirements and Exemptions. S Texas State Sales Tax Rate 625 c County Sales Tax Rate. 1 State lodging tax rate raised to 50 in mountain lakes area.

This tool is provided to estimate past present or future taxes. The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms. Payroll taxes in Texas are relatively simple because there are no state or local income taxes.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. This is the tax per night. Each local government determines its local hotel tax rate and the tax collected is sent to the local government entity.

Your average tax rate is 169 and your marginal tax rate is 297. The Comptrollers office administers the state portion of the hotel tax. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room.

Lodging is subject to state hotel occupancy tax plus each city andor county levies an additional local hotel occupancy tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts. For example the total cost of a nights stay is 13450 with the rooms pre-tax cost at 115.

6 state hotel tax. Sales Tax in Junction Texas is calculated using the following formula. There are no state or local hotel taxes on meeting and banquet rooms located in a building where no sleeping accommodations are provided.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Below is a summary of key information. 2 A state lodging tax is only levied in special statutory designated redevelopment districts at 50.

Many cities and counties levy additional hotel tax. Daily room rate charged by the hotel. 15-012 authorizing the Galveston Park Board of Trustees to be the responsible party for the receipt of Hotel Occupancy Tax HOT payments and Short Term Rental STR registrations.

Number of days traveled. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Multiply the tax on hotel bill by the percentage above to get the tax charged per day.

Texas Tax Code Sections 156103c 352007d 351006d The tax is. The purpose of the local hotel occupancy tax is to promote tourism and the convention and hotel industry. If you make 55000 a year living in the region of Texas USA you will be taxed 9295.

L Local Sales Tax Rate. Texas Hotel Occupancy Tax Texas Hotel Lodging Association Dora A. Local hotel taxes are levied on room nights costing at least 2.

Property management companies online travel companies and other third-party rental companies may also be responsible for collecting the tax. Texas has a 625 statewide sales tax rate but also has 982 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1678. To report and pay your taxes you must log in to your account and select the property you wish to report.

Local hotel taxes apply only to charges of at least 2 per day for rooms ordinarily used for sleeping. This is not an valid tax report. Convention hotels located within a qualified local.

A state employee is not exempt from paying a state county or municipal hotel occupancy tax collected by a commercial lodging establishment unless an exception applies. Tax on hotel bill for one 1 day. Multiply the tax per day by the number of days traveled to get the TOTAL REIMBURSABLE TAX.

For State Use and Local Taxes use State and Local Sales Tax Calculator. Take the tax on hotel bill for one 1 day. Divide the hotel tax per night by the cost of the room before taxes to get the rate.

So if the room costs 169 before tax at a rate of 0055 your hotel tax will add 169 x 0055 9295 or an extra 930 per night. Certain areas have extra territorial tax jurisdictions in which hotel tax is applicable. To pay taxes please log into your account or contact Hotel Help 512974-2590 or email at.

Texas state rates for 2021. No additional local tax on accommodations. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Your tax per night would be 1950. Local hotel taxes however are due only on those rooms ordinarily used for sleeping. If you have questions about HOT please call 214 671-8508 or 214 670-4540.

That means that your net pay will be 45705 per year or 3809 per month. This tool is provided to estimate past present or future taxes. 3 State levied lodging tax varies.

Determining the amount you pay in hotel occupancy tax is simple for locations with state HOT tax only with few exceptions a room costing at least 15 per night is subject to a 6 percent state tax anywhere in Texas. The state hotel tax rate is 6 percent. Cities and certain counties and special purpose districts are authorized to impose an additional local hotel tax that the local taxing authority collects.

To get the hotel tax rate a percentage divide the tax per night by the cost of the room before taxes. Hotel Occupancy Tax On February 12th 2015 Galveston City Council passed Ordinance No. A state employee is entitled to be reimbursed for hotel occupancy taxes incurred while traveling on state business.

Failure to comply may result in tax liabilities fines penalties and interest. 54 rows 125. Sales Tax Rate s c l sr.

Texas Income Tax Calculator Smartasset

Texas Income Tax Calculator Smartasset

Casio Sl300vcgnsih Solar Wallet Calculator With 8 Digit Display Green Sl 300vcgnsih Best Buy In 2021 Cool Things To Buy Display Casio

Hotel Occupancy Tax San Antonio Hotel Lodging Association

What Is Hotel Occupancy Tax Texas Hotel Lodging Association

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Do You Know How Much You Pay In Federal State And Local Taxes Bean Counter Tax Federal Income Tax

Taxes Celina Tx Life Connected

Taxes Celina Tx Life Connected

Why Are Texas Property Taxes So High Home Tax Solutions

City Tax Rate South Padre Island Texas

Texas Income Tax Calculator Smartasset

Home Insurance Companies Keller Texas Home Insurance Life And Health Insurance Homeowners Insurance